For many Americans, making it to retirement is a lifelong goal. But shouldn’t our goal be more than just making it there? Shouldn’t it be to actually enjoy our retirement years? When it comes to planning your retirement, annuities are not only a powerful way to increase your income, they are also designed to help you protect what you’ve worked for your whole life. Take a look at this document to learn more about how they do it.

Are you concerned at all about your income during your retirement years? Many annuities can also guarantee a paycheck for life! As many people enter retirement, they tend to underestimate the amount of money they will need to continue the lifestyle and comfort they had pre-retirement. Subsequently they find themselves seeking employment. With healthcare costs rising, along with inflation and market volatility, and the fact people are simply living longer, you don’t want to find yourself looking for additional income when you would rather be enjoying your time. Ask us how we can guarantee you will never outlive your income!

Just when should you consider purchasing an annuity? According to many experts, the sooner the better. Take a look here at the potential cost of procrastinating.

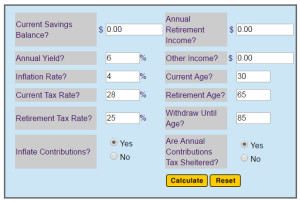

Are you more of a number-cruncher? Use the calculator below to get an idea of where you need to be now to have a comfortable lifestyle later. Then contact us to help you get where you need to be!

Check out this informative, easy-to-understand video regarding the challenges we all face when it comes to retirement, and how we can overcome them.